Few issues are causing as much debate among central government employees and pensioners as the introduction of the 8th Pay Commission. Salary and pension hikes are getting people excited, so there’s a lot of curiosity as to what the 8th Pay Commission can do. The Pay Commission might bring along salary hikes, fitment factors, and other changes.

Salary Calculator for the 8th Pay Commission in India

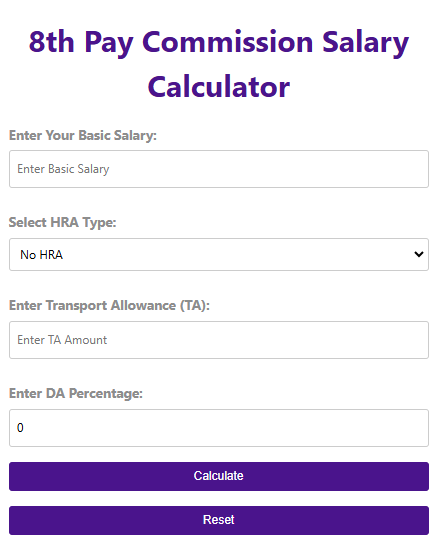

Using the latest pay commission guidelines, this calculator lets you figure out your new salary. Take your basic pay, Dearness Allowance, House Rent Allowance, Travel Allowance, and other deductions to figure out your net salary.

There is excitement among government employees about the 8th Pay Commission’s salary revision. Their excitement about the new salary scale is growing. To determine how salaries might change, the 8th Pay Commission salary calculator is now a useful tool.

Basic Salary Calculator – 8th Pay Commission

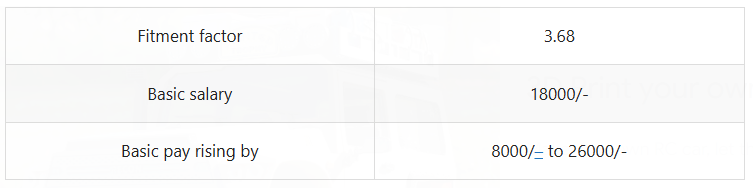

The report update indicates that the figment factor should be set to 3.68 times. An employee of the government receives the following salary:

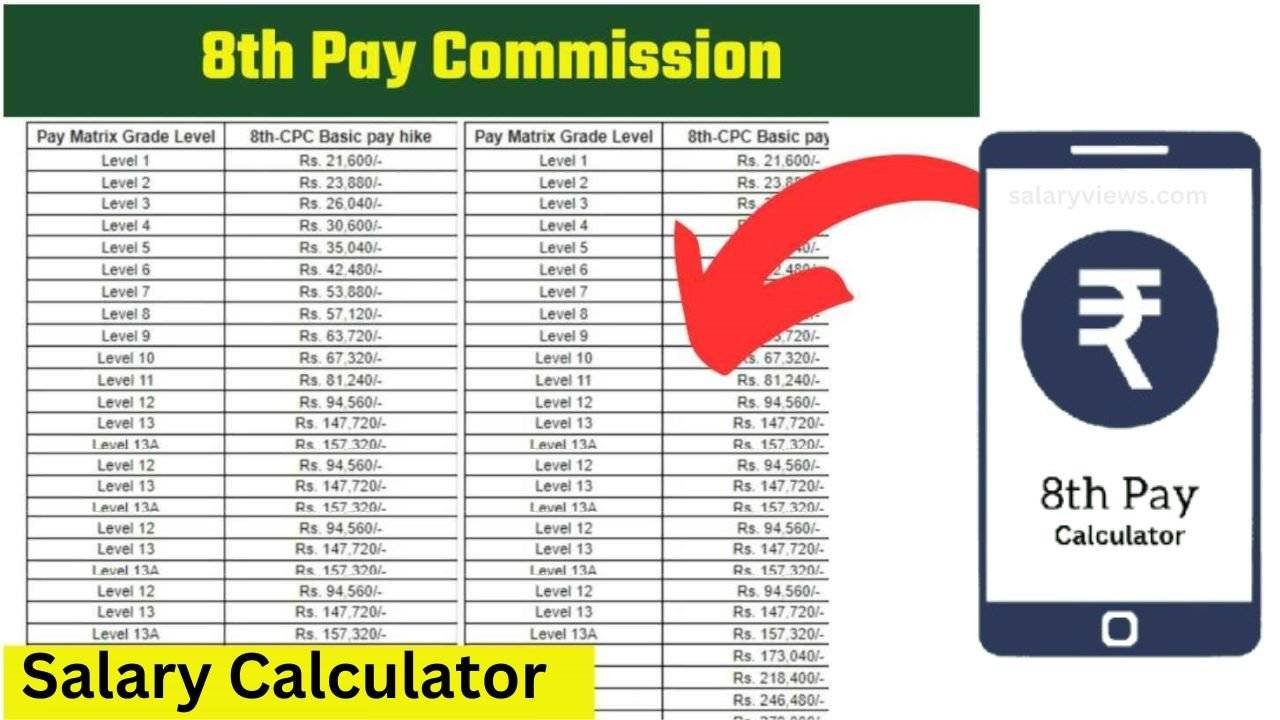

Comparison of Salaries with Previous Pay Commissions

| Pay Commission | Fitment Factor | % Of Increase | Minimum Pay |

|---|---|---|---|

| 2nd CPC | – | 14.2% | Rs.70 |

| 3rd CPC | – | 20.6% | Rs.196 |

| 4th CPC | – | 27.6% | Rs.750 |

| 5th CPC | – | 31% | Rs.2550 |

| 6th CPC | 1.86 | 54% | Rs.7000 |

| 7th CPC | 2.57 | 14.29% | Rs.18000 |

| 8th CPC (Anticipated Values) | 2.28 | 34.1% | Rs.41000 |

Checkout: How Much Does a Nurse Earn in Japan?

Features of 8th Pay Commission’s Calculator

- State Selection: All states and union territories are included in the calculator to provide accurate Professional Tax (PT) calculations

- Classification of Cities: Cities are divided into X, Y, and Z categories. These affect the House Rent Allowance (HRA)

- Pay Levels and Basic Pay Options: As a result of selecting a Pay Level, the calculator automatically updates the Basic Pay options

- Detailed analysis: Calculates earnings (Basic Pay, DA, HRA, Taxes, and Tax on Taxes) as well as deductions (NPS, Professional Tax, Medical Deductions)

- Provides accurate deductions: Takes into account the state you live in when calculating professional taxes (PT) and other standard deductions, like NPS and medical allowances

- Calculation of Net Pay: Indicates the take-home pay after all earnings and deductions have been taken into account

8th Pay Commission Calculator benefits

- Accuracy: Makes certain that all allowances and deductions are taken into account by the latest pay commission guidelines.

- Customization: Calculates HRA and Professional Tax according to the user’s local circumstances.

- Transparency: Make sure employees know their whole salary, including deductions and earnings.

- Ease of Use: Users can use it easily thanks to an intuitive interface with clear instructions and dropdown menus.

- Plan: Estimates your net salary, which aids in budgeting and financial planning.

8th Pay Commission Salary Factors

It will take until the 8th Pay Commission sets new salaries for government employees. Factors such as the minimum wage, Dearness Allowance (DA), and fitment factor will determine the final pay. Based on these elements, the pay commission will make recommendations.

01. Minimum Wage Calculation

Norms of the 15th Indian Labor Conference (ILC) and the Dr. Akroyd Formula will be used by the 8th Pay Commission for calculating the new minimum wage. An important part of the guidelines is to consider how much a family can afford for essential items. Workers are guaranteed a minimum wage to cover their basic needs.

02. Rate of Dearness Allowance (DA)

The Dearness Allowance (DA) is an important component of the pay plans of the 8th Pay Commission. As early as January 1, 2026, the DA rate is estimated to reach 70%. From this date on, the pay commission will be in effect. There will be an impact on final salaries due to increases in DA.

03. Fitment Factor Calculation

As part of its plan, the 8th Pay Commission has established a Fitment Factor, or Uniform Multiplication Factor. According to the current Dearness Allowance, it is calculated. According to our expectation, the Fitment Factor will be 2.28.

The 8th Pay Commission salary structure and recommendations will heavily depend on these factors – minimum pay, dearness allowance, and fitment factor.

Calculating Salary for Eighth Pay Commission: How to do it?

- Select State: This selection must be made before the Professional Tax (PT) can be calculated

- Select City: The type of city you live in (X-City, Y-City, Z-City) will appear. In this regard, the House Rent Allowance (HRA) will be paid at a higher rate than before

- Pay Level: You can select your pay level by clicking on the dropdown. Based on your selection, the calculator will automatically fill in the options for Basic Pay

- Basic Pay: From the options provided, choose your basic pay—the options change based on the Pay Level

- Travel Allowance (TA): Make sure the Travel Allowance you select is appropriate to your pay level and location

- Medical Deductions: Any medical deductions applicable to your situation should be entered here

- Calculate: Using the button “Calculate” you are able to view the breakdown of your salary as well as your net pay for the year

Leave a Reply